Before July, Sezzle’s average monthly cash burn had already fallen for three consecutive quarters.

This means that the company’s cash burn – defined as the total income less transaction-related costs minus operating expenses, fell to $1.8 million in July. Sezzle’s July business update indicates that it further reduced its cash burn following sustained efforts to trim expenditures.Īccording to the update, Sezzle’s operating expenses fell to USD$5.8 million in July, compared to a monthly average of $6.9 million in the second quarter of 2022 and $7.7 million in the first quarter.īy contrast, total income less transaction-related costs was $4 million in July, a leap of 25% compared to the monthly average of $3.2 million for the second quarter. Sezzle’s July update indicates that the installment payments company has continued to trim its cash burn in its push toward profitability.

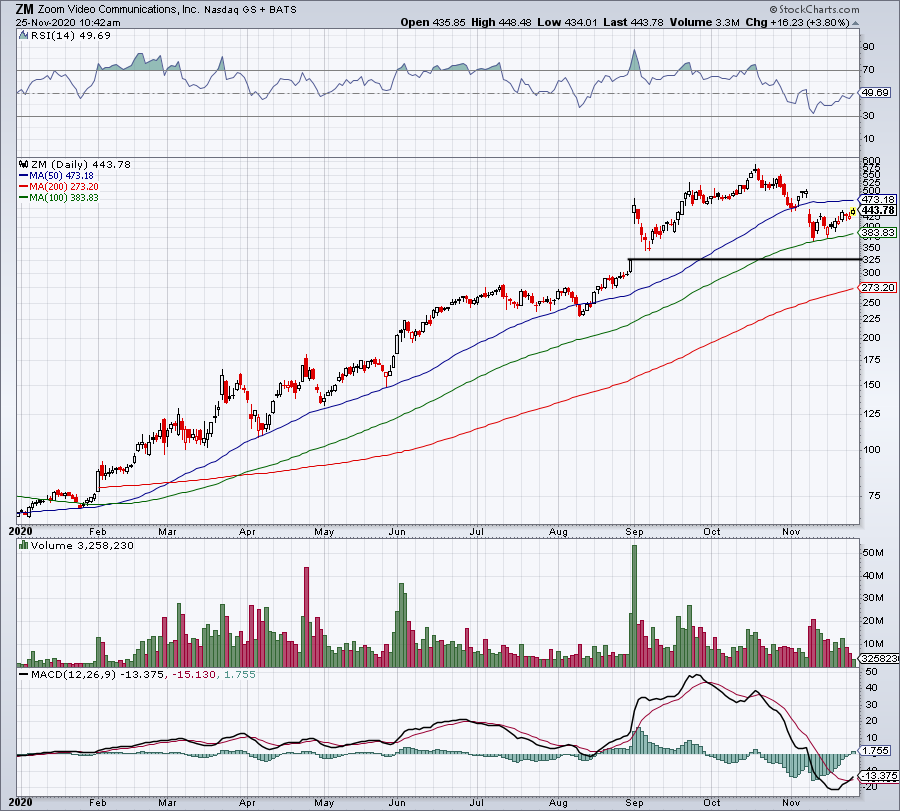

Still, Ed Ponsi, TheStreet’s Founder Ponsi Charts and Managing Director of Barchetta Capital Management, Ed Ponsi, says the strong guidance points to continued momentum in demand at least for now.ASX-listed buy-now-pay-later (BNPL) company Sezzle could see its share price rise on efforts by the company to achieve profitability by the end of 2022. Some analysts do warn, though, that some of the demand surge in software may be pulling forward from years in the future that may disappoint, relative to current trends. The market cap is now about 42 times management’s 2021 sales estimate, leaving more room from upside even from the stock’s current level. Adjusted earnings per share was guided for a mid point of $2.44. Management is guiding for full-year 2021 revenue of roughly $2.38 billion, another relatively strong growth rate over 2020 expectations. Adjusted eps in the same quarter last year was 9 cents, making this year’s growth more than explosive. The strong operating leverage helped power the profit growth, although the pure demand for Zoom’s offerings were the major driver.

0 kommentar(er)

0 kommentar(er)